Navigation

Close

Mirabaud Sustainable Cities

Q1 2024 analysis by L’Observatoire Credit Logement/CSA1 showed:

1. Residential mortgage rates have begun to decrease

2. Residential mortgage issuance volumes are increasing

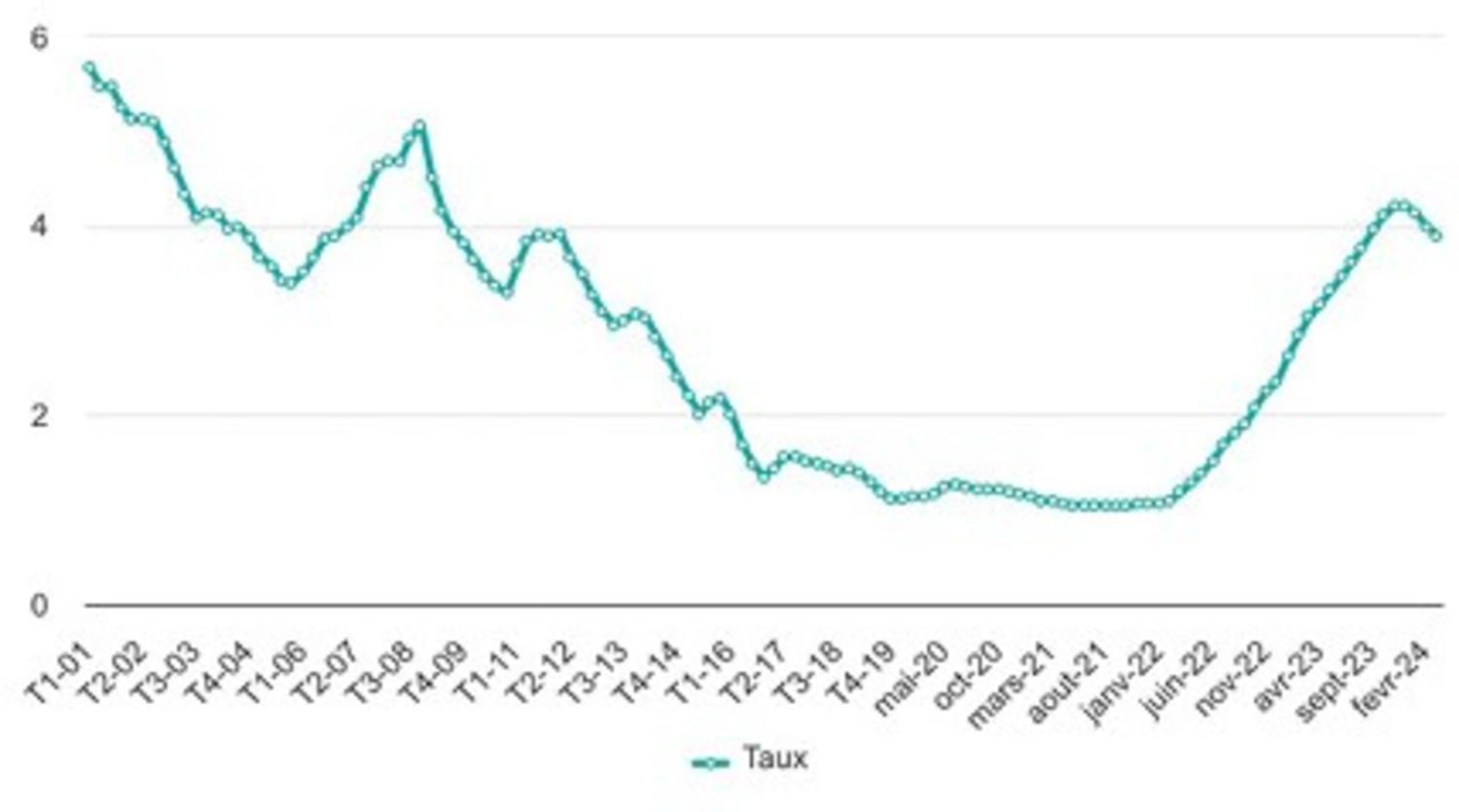

Since the start of the year, the average residential loan rate has decreased by approximately 10bps per month, falling from the peak in November and December 2023 of 4.21% to 4.13% for January, 3.99% for February and 3.90% for March.

Of particular note, January’s data showed a 22bps rate decrease on 25-year loans, which account for 51.5% of total mortgage issuance. These loans are generally granted to first-time buyers, who are typically young and less well-off than borrowers who choose shorter terms, suggesting banks are striving to support a clientele that would not otherwise be able to enter the real estate market.

In terms of residential mortgage issuance, levels increased by 51.8% between December 2023 and March 2024. The figures are particularly notable as the early months of a new year typically deliver stagnation in rates, rather than declines.

The consensus view on Q1 2024’s data is that the worst is likely over for the residential new-homes sector.

Why is this news positive for the strategy?

Typically, we have a number of programmes in the portfolio that are designed to be sold to private individuals; these are separate to social and intermediary housing projects, which are developed for the rental market. For private individuals, rates and availability are critical for maintaining demand, so we view the Q1 data as very positive news.

The climate in the banking sector appears to be turning more positive and there is a desire to distribute credit, which is having a positive trickle-down effect across the market. The developers we work with have noted the number of unit reservation cancellations has decreased. In the past, cancellations typically occurred due to credit refusal by banks, but this trend is now changing direction and gross reservation numbers are stable to increasing.

For 2024, forecasts are indicating a stabilisation of mortgage rate at an average annual level of 3.60%.

1 L’Observatoire Credit Logement / CSA with additional analysis provided Journal de L’Agence

Mirabaud Sustainable Cities

Private Assets

Continue to

Private Assets

Mirabaud Sustainable Cities

Mirabaud Sustainable Cities

Private Assets